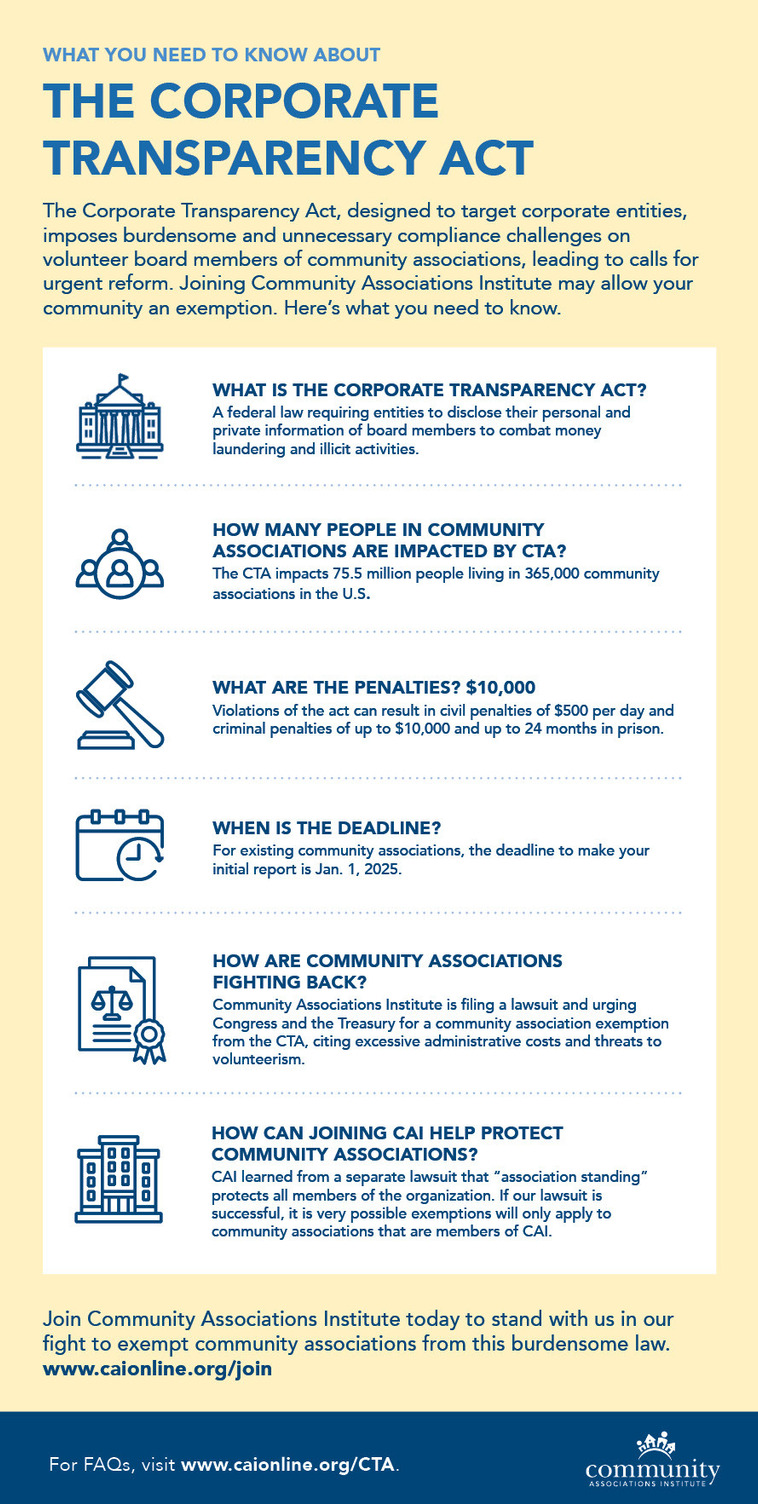

Corporate Transparency Act

The Corporate Transparency Act (CTA) was signed into law Dec. 2020 and is now in effect for many community associations. This law will require community associations with fewer than 20 employees and less than $5 million in annual revenue to disclose beneficial owners’ information to the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

While we support the goal of stopping money laundering and funding schemes for terrorist activity, this is not good public policy for community association boards of directors. CAI believes community associations were unintendedly caught up in this law which is intended for corporations laundering money for terrorist activity. Failure of a volunteer community association boards to comply—intentional or not—could result in up to $10,000 in fines and up to two years in prison.

CAI's Lawsuit:

On September 10th, CAI filed a lawsuit against the U.S. Department of the Treasury, Secretary Janet Yellen, and the director of the Financial Crimes Enforcement Network, challenging the application of the Corporate Transparency Act on community associations. This action is being taken to protect our members from the burdensome and unnecessary requirements of the Corporate Transparency Act. Both the lawsuit complaint and motion for preliminary injunction can be found HERE.